The decades-old stadium and arena refrain of “beer, here!” from exuberant hawkers, a sound almost as ingrained with the in-person sports experience as the roar of the crowd itself, is increasingly being joined by a transformative wave of self-serve beverage technology.

Mirroring a rising trend of consumer-directed and automated experiences in many other areas of commerce, such as checkout-free stores, self-serve beverage technology has now reached several dozen major stadiums and arenas in North America, allowing fans to purchase both alcoholic and non-alcoholic drinks themselves, often in a matter of mere seconds.

That technology has arrived in numerous individual forms, ranging from high-end vending machines focused on canned beer to virtual bartenders capable of producing a wide variety of mixed drinks and cocktails.

But in each instance, the core goals from deploying that technology are essentially the same: reducing wait times that remain a key pain point in the overall fan experience, curbing product waste and spillage, and generating additional revenue for stadium operators and partner concessionaires.

More options means more sales

“There’s clearly been a shift toward automated, unmanned solutions for food and beverage, and we’re part of that wave,” said Corey Yantha, founder and chief executive of Dispension Inc. Dispension, a Canadian company that last year introduced its SmartServ beverage technology at Dodger Stadium, home of Major League Baseball’s Los Angeles Dodgers for the league’s 2022 All-Star Game, is now finalizing installation deals with two other pro venues.

SmartServ has focused on self-serve beer in large-format cans typically around 24 ounces.

“Conversion rates are really important to these venues. And by increasing points of sale, and reducing congestion and lines in the concourse, people are going to spend more,” Yantha said.

Given the confined spaces at many stadiums and arenas and the need to maintain fan flow for safety reasons, simply increasing beverage points-of-sale in a traditional, manned sense is frequently not possible. But the automated self-serve beverage technology, typically taking on the form of a large vending machine or a portable van-sized cart, is often placed along otherwise blank concourse walls and in previously unused corners of venues.

“The mobile self-serve space is definitely something where we’re seeing particular growth,” said Ben Maphis, vice president of technology for Sestra Systems, a Virginia-based company working with a dozen venues, including Gillette Stadium, home of the National Football League’s New England Patriots, and Levi’s Stadium, home of the NFL’s San Francisco 49ers.

Covid-19 as an accelerant

While the roots of self-serve beverage technology go back in earnest at least a decade, and perhaps beyond that to traditional vending machines, it was the Covid-19 pandemic that really helped catapult these offerings to the forefront.

With most venues unable to host fans for at least a year during the worst of the public health crisis, vendors of all stripes that serve those buildings were left with vast amounts of extra time for research and development. And when attending fans began to return in full in 2021, many concessionaires found that restaffing to full, pre-pandemic levels a marked challenge.

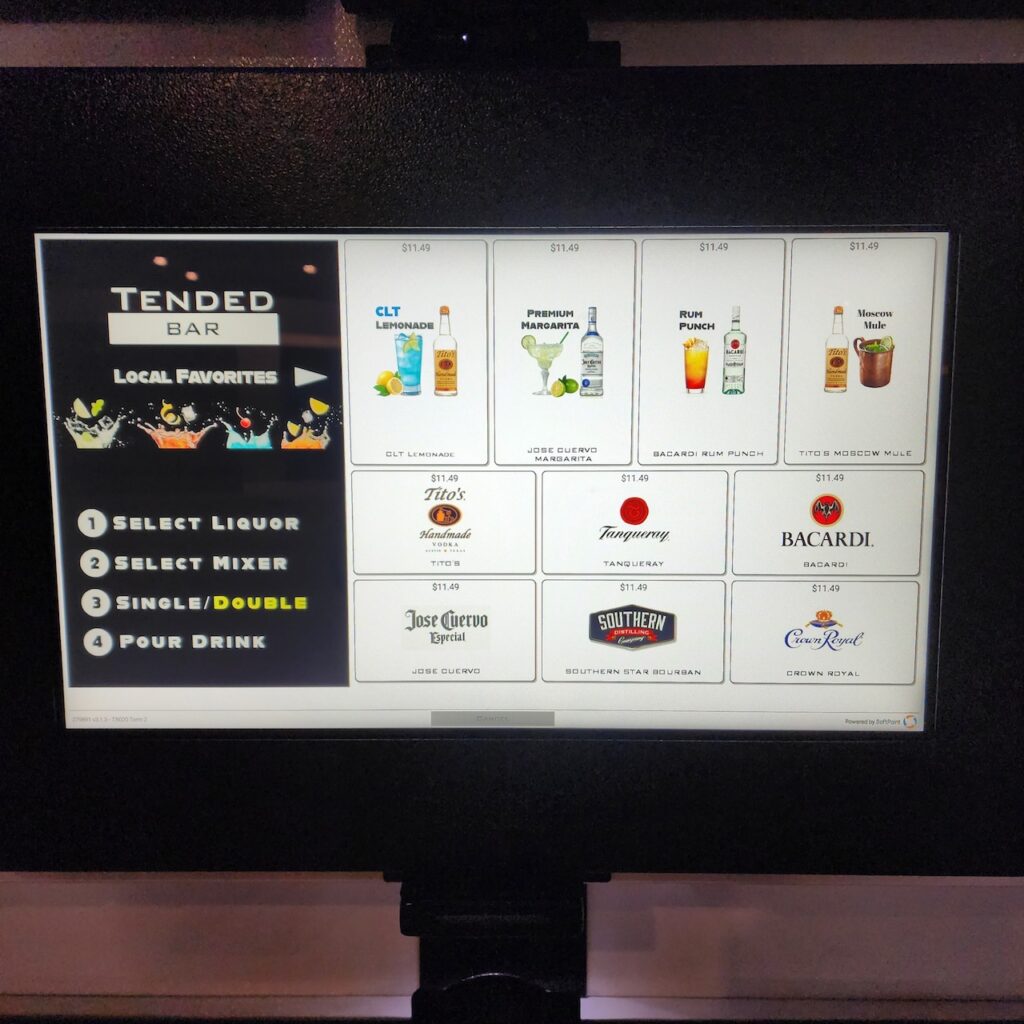

“There were a lot of people sitting around [during the pandemic], and we looked to use that time [to develop its systems],” said Justin Honeysuckle, chief executive of TendedBar, a Florida-based provider of automated systems that produce custom-made cocktails.

TendedBar is now in nearly a dozen major venues, including Bank of America Stadium in Charlotte, North Carolina; TIAA Bank Stadium in Jacksonville, Florida; Empower Field at Mile High in Denver; Allegiant Stadium in Las Vegas; and Circuit of the Americas in Austin, Texas, with several other new accounts in active development.

Adds Dispension’s Yantha, “We knew there was a big opportunity to distribute canned beverage in stadiums, where there was a lot of challenges with congestion, long lines, and staffing issues, which grew over the course of the pandemic.”

But as matchmaking between vendors, teams, venue operators, and concessionaires increased during the pandemic, those vendors still found resistance in many sectors from a sports industry still tradition-bound in many ways.

And despite existing challenges in serving fans in a timely fashion, providers of self-serve beverage technology often find their biggest competitor isn’t another vendor, particularly as many of the key competitors have staked out their own specific lanes within this burgeoning space.

Rather, the primary competition is often a regular bartender or manned concession stand.

“The biggest thing we’re competing against is the status quo, both at the back end, and with consumers,” Honeysuckle continues. “Changing processes is initially difficult, and there’s a bit of an initial learning curve compared to throwing ice in a trough and putting bottles out on a counter.”

As that product differentiation between different self-serve technologies continues to codify, the willingness among various technology providers to service and sell different type of beverages has also increasingly varied. Some vendors and systems openly embrace all types of alcoholic and non-alcoholic drinks, while others have found that soda and water don’t have a sufficient profit margin for the revenue-sharing agreements many of the self-serve companies have with concessionaires and venue operators.

“We’re there to help the clients make the most money possible,” Honeysuckle said. “Selling a 42-ounce soda for six bucks isn’t the market we’re trying to have compared to selling $20 liquor drinks.”

Differing authentication technologies

With any self-serve beverage technology providing alcohol, the foremost question is how to deliver that product, but maintain age verification and comply with local laws.

Initial age-verification systems in this area relied in on RFID-based technology, wristbands, and pre-registration. More recent applications, however, have largely shifted to age-gating based on facial recognition, typically deployed in combination with user driver licenses or other identification that matches photos on those IDs with real-time facial scanning as that user approaches the beverage machine.

But there are additional operational and legal concerns.

“In the alcohol world, it’s not just, ‘are you 21?’ It’s also, ‘are you not drunk?’,” said Jose Hevia, chief executive of DraftServ, a Georgia-based company that made an initial splash with its automated beverage system at Major League Baseball’s 2014 All-Star Game, and has since moved into an Internet-of-Things (IOT) model of helping teams and concessionaires automate and connect existing beverage systems.

Yantha and Dispension, which initially built its corporate base by developing kiosks to safely distribute a variety of regulated products, are now developing a patented solution called Intoxivision that uses thermal imaging to determine in a contactless fashion whether or not a consumer is intoxicated. The company is looking to introduce that emerging technology by the end of 2023.

But in the short term, many self-serve beverage systems still require some manned support and monitoring, not unlike how self-scanning lanes at a grocery store that have on-floor management present to help shoppers.

“There’s still an oversight component to self-serve alcohol systems that won’t be fully automated in the near future, particularly from a liability standpoint for venue operators,” Hevia said.

Performance improvements over old methods

Not surprisingly, the self-serve beverage systems often offer a sizable difference in performance improvements compared to traditional methods. TendedBar, for example, claims a throughput rate of 35 people per five minutes at a single, four-screen bar. Such a delivery rate, combined with the level of drink customization that the system provides, would be hard to match in a normal, manned setting.

“That number stands by itself in a high-volume environment,” Honeysuckle said. “And we’re making a fresh drink every time.”

At many venues, though, the self-serve technology is not simply about improving speed of service or overall revenue, or necessarily those factors at all, but also about offering a differentiated level of fan experience. Other systems such as DraftServ place a high priority on curbing spillage and waste and maximizing product yields from beer kegs and other beverage dispensers.

“It really depends on what you’re trying to solve for,” which can vary widely by team or venue, said Alicia Woznicki, vice president of design and development for Aramark Sports and Entertainment, a major concessionaire which works with hundreds of pro and collegiate teams and has actively explored self-serve beverage technology for the better part of a decade. “Are you trying to offer a cool, experiential amenity, or are you trying to get back people back to their seat and happy they have their beverage?”

To that end, Woznicki says Aramark’s efforts to date in the self-serve beverage space have often seen better performance metrics from efforts that more closely mirror retail and commerce applications outside of sports venues, such as selling bottled products with checkout-free technology.

“In Asia, anything comes from a vending machine, and people are willing to adopt that,” Woznicki said. “But [in North America], we haven’t seen the same kind of adoption on the vending [-based technologies] yet that we would have hoped for. So we have to figure what is the right way to set up the solutions, and make sure they don’t get lost on the concourse.”

Ultimately, self-serve beverage technologies in sports will also borrow heavily from other areas of hospitality and entertainment such as hotels, theme parks, movie theaters, chain restaurants, and airports – all high-volume areas that are key targets for many of the primary vendors in this space.

“The addressable market is so much larger than just sports venues,” Honeysuckle said.

Eric Fisher is a freelance writer based in New Jersey. He has covered the sports industry for nearly three decades, including prior editing and reporting roles with SportBusiness and Sports Business Journal. He is a proud graduate of St. Bonaventure University. This is his first article for Stadium Tech Report.