After eight years of searching for a market for its radically different mobile connectivity technology, long-simmering startup Artemis Networks may have finally found a potential home in private CBRS networks for stadiums.

On Wednesday the San Francisco-based startup led by tech entrepreneur Steve Perlman — whose claims to fame include working on QuickTime at Apple and building WebTV, one of the first consumer Internet platforms — announced a trial of its “pCell” technology with the San Jose Sharks and SAP Center, where according to Artemis its technology is able to provide wireless Internet-access services for fans that is faster and more reliable than regular cell networks or Wi-Fi.

According to Artemis its “pCell Multi-Gigabit LTE/5G vRAN (Virtualized Radio Access Network)” can deliver “10 times the capacity of regular 4G LTE or 5G networks in the same amount of spectrum”. Perlman said the first large-scale pCell vRAN installation, now live in the SAP Center in San Jose, uses 20 MHz of unlicensed CBRS spectrum to deliver an average throughput of 1 Gbps to every device connected to the network, no matter where that device is inside the seating bowl. Though the network is only being used by a small beta-test segment of users right now, Artemis said it will eventually be offered to all attendees at events at the 20,000-seat SAP Center later this year.

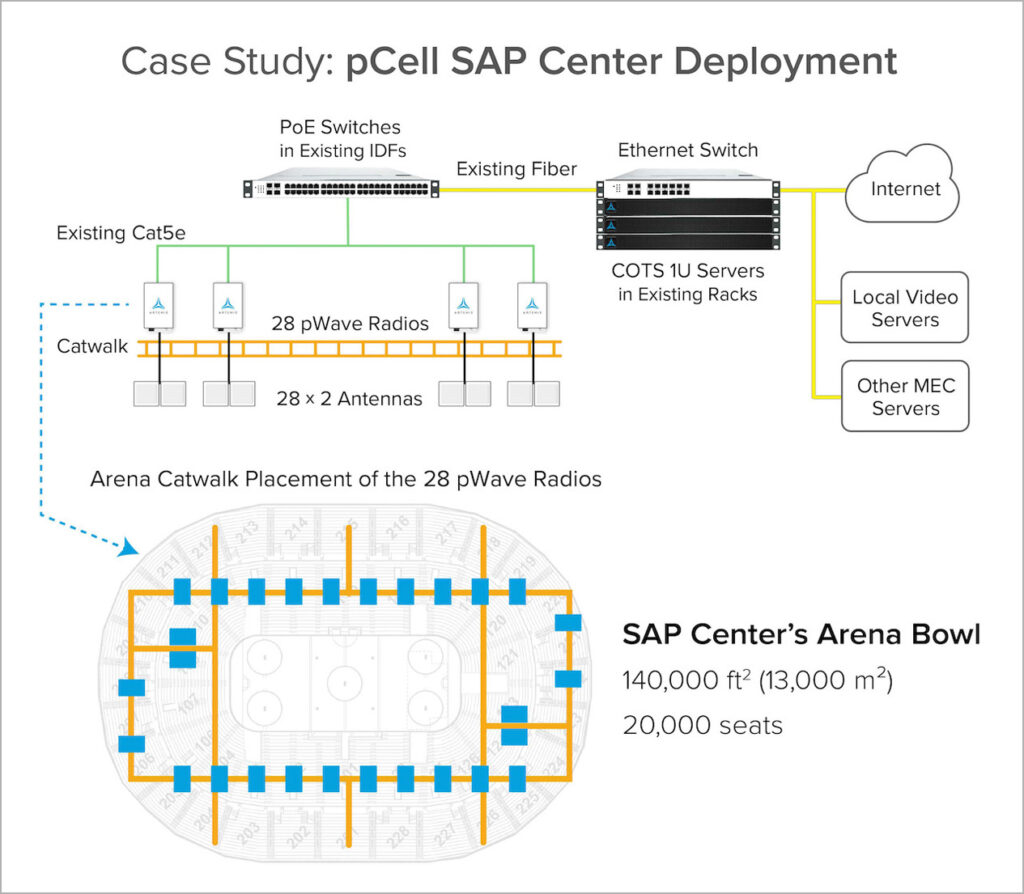

As the first real public test of the technology at scale, real-world observers will finally get a chance to see if Perlman’s claims for pCell will deliver as promised. It may be hard for veterans of the industry to accept that a network with only 56 antennas, mounted somewhat randomly in the stadium’s upper infrastructure, will be able to provide faster and more balanced Internet access than the stadium’s existing Wi-Fi and cellular networks combined. But the ever-confident Perlman can’t wait to have others kick the tires on his long-gestating project, which was initially unveiled to the public in February of 2014.

“It’s been a long, long, road,” Perlman said in a phone interview last week. “But it’s extremely gratifying to see it finally happening.”

And though his stadium hasn’t yet seen the technology working for a full house of fans, San Jose Sharks president Jonathan Becher is an early believer, foreseeing the technology’s ability to deliver support for high-bandwidth services like augmented-reality applications in the near future. In a video on the Artemis website, Becher says the pCell network “could change the experience in venues like ours,” and “help keep seats filled.”

Embracing interference instead of avoiding it

Since its inception, the Artemis pCell technology has been a hard one for many wireless veterans to grasp, since it seems to fly in the face of conventional wisdom like no other technology before it. What Perlman and Artemis claim is that the company has developed a way to build radios that transmit signals “that deliberately interfere with each other” to establish a “personal cell,” or pCell, for each device connecting to the network.

Leaving the complicated math and physics to the side for now (if you are interested in diving deeper the Artemis website has many technical papers to peruse), if Artemis’ claims hold true its technology could solve two of the biggest problems in venue wireless networking, namely bandwidth congestion and antenna interference. In current cellular and Wi-Fi designs, devices share signals from antenna radios, meaning bandwidth is reduced as more people connect to a cellular antenna or a Wi-Fi access point.

Adding more antennas is one way to solve congestion problems; but especially in stadiums and other large public venues, you can’t place antennas too close to each other, because of the potential for signal interference. Trying to design high-density networks for both Wi-Fi and cellular is perhaps the hardest part of a stadium-network equation, requiring extensive experience and repeated, thorough testing for optimization.

But according to Perlman, pCell networks have no such requirements, since in the technology’s mesh-type arrangement the individual antennas act much differently than those in regular cell networks or Wi-Fi.

“What’s nice about pCell is that there is no cell planning, so long as the pWaves [antennas] are generally spread apart, they will work fine, regardless of the arrangement,” Perlman said. “You can deploy the networks rapidly. You don’t need a specific design.”

CBRS spectrum finally opens a window of opportunity

One of pCell’s biggest strengths — and its initial Achilles’ heel — was that it was developed to be used by off-the-shelf, standard LTE cellular devices. In theory that made the technology simple to use; but because large carriers and their traditional large equipment providers controlled cellular access tightly, it was a struggle for the small Artemis to find a commercial customer. While the company staged some impressive demos of the technology, its attempts to find some licensed spectrum to provide real services were stymied, and a white-label deal with Nokia failed to bear fruit, forcing Artemis back to the drawing board.

“We pivoted,” said Perlman of the self-funded company, which he said was able to stay small and keep a lean burn rate as it waited — years — for a better opportunity. The first block to fall in place was the FCC’s approval of the CBRS spectrum, which meant that LTE services could finally be offered in a private way on unlicensed spectrum, much like Wi-Fi networks have been. Though CBRS deployments have been somewhat slow to take off in the venue space, Perlman said the underwhelming performance of the much-hyped 5G networks from major cellular carriers have opened a window of opportunity for a high-speed network alternative, especially one that is much cheaper and easier to deploy. And with bigger players like Amazon’s AWS services getting into the private networking market, Perlman said the concept is starting to gain momentum.

“Private networks are happening now,” Perlman said. “We don’t have to invent the category.”

For the SAP Center network Artemis is working with CBRS service provider Federated Wireless to provide the back-end services necessary to ensure that the shared spectrum activity doesn’t interfere with military communications (the spectrum was originally allocated only to the U.S. Navy). Perlman said the pCell private networks would be priced on a subscription model, with the cost based on how much bandwidth the customer requires. For its first network the pCells will be using 20 MHz of unlicensed CBRS spectrum, with 28 pWave radios, each connected to two antennas. The only other gear from Artemis in the network is three 1U servers; the systems, Perlman said, can use existing fiber, cabling and switches already in a venue’s infrastructure. And while he wouldn’t reveal an exact price tag, Perlman said pCell networks would be “a fraction of the cost” of regular stadium cellular or Wi-Fi networks.

Like other private CBRS networks, the Artemis deployments will require users to either add a physical SIM card to their devices or to configure an eSIM in their phones to connect to the network. Phones also need to have radio support for the CBRS bands, something that most new phones have but older ones don’t. For eSIM configuration, Artemis and the Sharks plan to have directions in the stadium app as well as at information kiosks throughout the venue. While Perlman acknowledged that “we don’t expect everyone [at a venue] to suddenly jump on board,” he was also confident that more savvy users with the latest devices would help with adoption rates.

“With more than half the phones out there capable of connecting, that’s enough to get the train rolling down the track,” Perlman said.

But can it scale?

With no real public chance to prove his company’s technology in the past eight years, Perlman seems to have anticipated all the skeptical questions, like whether or not the pCell networks can handle the large demands of a stadium network.

“That’s always the question, can it scale,” Perlman said. While internal tests can only be trusted so far, Perlman actually bought 400 phones and used them to test the SAP Center network in various ways, including side-by-side comparisons with the Wi-Fi and cellular networks already inside the building. Even taken with the proverbial grain of salt, the findings — like providing 20x the bandwidth of Wi-Fi connections and 10x the bandwidth of cellular connections — are likely to generate at least some interest among most venue IT professionals.

Perhaps even more important may be Artemis’ claim of providing equal service to every device inside the seating bowl, no matter where the device is. That would be a huge improvement over most cellular and Wi-Fi stadium networks, which typically have zones of significantly different performance due to factors like not being able to mount an antenna close enough to seats to provide coverage. Though right now the SAP Center pCell network does not provide coverage to the concourse (signals in the 3.5 GHz bands do not travel well through concrete walls), Perlman said other areas could easily be covered by adding more radios and antennas to the mix.

In terms of throughput, Perlman notes that the higher-end Artemis servers (like the ones in SAP Center) use AMD’s 64-core supercomputer CPUs, which he said can more than handle the necessary back-end processing chores.

“The servers can easily handle the traffic,” Perlman said. “We have two dual-port 100 Gbps Ethernet NICs in each server, and if needed, we could put in faster Ethernet NICs or more of them. The servers have no trouble handling 400 Gbps of traffic.”

To gain more throughput, an Artemis network can simply add more servers and more antennas and more spectrum, according to the company. By using the full 150 MHz of the CBRS unlicensed band, a pCell network could support throughput of more than 7 Gbps, Perlman said. Perlman also said the pCell networks can work in outside stadiums, like football stadiums, music venues or racetracks.

With the caveat of “if it works” the pCell technology could possibly be of highest interest to smaller venues, like those at smaller schools where budgets may make installing a full Wi-Fi system fiscally impossible, and where major carriers are in no rush to join a shared distributed antenna system (DAS). At the very least, the technology’s jump from experiment to product should be interesting to watch.